Although this sounds easy, making accurate calculations can be tricky, especially when you manage several Airbnb listings. Add an Airbnb accounting payout method for a bank account just for your rental properties. Using separate bank accounts makes it easier to record bank transactions and calculate expenses for rental and personal use. Whether you’re an enterprising Airbnb host managing short-term rentals or an independent contractor navigating the world of self-employment, our CPAs are here to help. We will provide you with the guidance, expertise, and support necessary to optimize your financial success.

Why Are Bookkeeping and Accounting Important for Vacation Rental Businesses?

Airbnb Hosts or Co-Hosts who are US citizens or US tax residents with reservations and/or Experiences transactions. However, if you purchase a plan right away, then you get 50% off on the first three months, plus a free meeting with a ProAdvisor to get you started. However, we want to see Baselane add a CRM for storing and organizing guest and tenant records. If you didn’t receive an email don’t forgot to check your spam folder, otherwise contact support. Get a consolidated ledger of all transactions categorized by property and Schedule E category.

Pricing

- The IRS doesn’t take kindly to errors, and the penalties can be severe.

- Ultimately, the host is responsible for collecting these taxes from their guests and remitting them to their local authority.

- This involves not just handling yearly tax returns but also strategic planning for future growth.

- If you have multiple listings with check-ins on the same day, funds will usually be deposited as a single payout.

- Residents of high-tax states such as California, New York, New Jersey, and Florida (property taxes) will feel this the most.

From calendar year 2023 moving forward, Airbnb will send a 1099-K form to hosts who make $600 or more in aggregate over the course of the year. 4Some states require an interest-bearing escrow account for security deposits while some don’t require interest. https://www.facebook.com/BooksTimeInc/ User is responsible to check state laws along with rules for collecting and reimbursing a refundable security deposit. A brief overview of security deposit laws for escrow accounts in all 50 states can be found here. Our services allow you to increase productivity with the freedom to manage your community and focus on daily operations. Make sure your listing details and photos are setting accurate expectations.

QuickBooks Online: Best Comprehensive Solution for Airbnb Hosts

There are many expenses required to keep your listing looking good, and ensure that your clients leave your Airbnb satisfied with their stay. You’ll want to keep records of these for major purchases such as furniture and supplies. For Airbnb hosts who own their home, the biggest and often more complicated deduction has to do with the depreciation of your home. Depreciating your home helps determine how much of your asset’s value has been used up on an annual basis. You would take the total purchase price, assign a business percentage, then spread the cost over its useful life (as of 2018, 20 years).

- You would take the total purchase price, assign a business percentage, then spread the cost over its useful life (as of 2018, 20 years).

- Xero is unbeatable when it comes to enabling data-driven decisions for your Airbnb business.

- Tracking everything at once can be challenging, but you need to do it to minimize your tax bill on the gross rental income.

- Simply put, Airbnb accounting is the process of recording income and expenses related to your rental property.

- Also, it has no property management features, like booking and channel management, which are typically found in specialized property management software like OwnerRez and Baselane.

FreshBooks Pricing

The system determines which taxes are applicable based on the listing address. If there isn’t an option for local tax collection in your area, you are responsible for calculating, paying, and remitting taxes. On the local level, hosts should be aware of occupancy taxes, transient occupancy taxes (TOT), and local sales taxes that may apply to short-term rentals. Hosts can write off all or a portion of indirect expenses from rental property income. The amount depends on what part of your home is used for rental purposes and how long it’s occupied. This situation creates an Airbnb accounting challenge for Schedule E categorization and reconciliation.

- They provide personalised tax strategies tailored to your specific circumstances.

- You must also report your gross earnings (completed payouts) and allowable expenses.

- Most hosts pay 3%, but some pay more for Plus Airbnb listings or strict cancellation policies.

- FreshBooks lacks rental management-specific tools, but it has a few features that are useful to owners.

The IRS established a safe harbor rule that allows hosts to deduct expenses that might otherwise be considered improvements and subject to depreciation. The safe harbor rule allows you to deduct a certain amount in a single year without having to record every receipt to support the deductions. This can be a substantial deduction to allow improvements to your rental. Since Airbnb launched in 2008, home airbnb accountant sharing has taken the world by storm. And with all fast-growing businesses, a lot of the success we’ve seen has come with its fair share of growing pains for Airbnb hosts. One major difficulty we hear from our hosts deal with (after a successful year) is Airbnb taxes and accounting.

- On the downside, OwnerRez lacks a mobile app, which could have been a useful feature for accepting payments and tracking expenses on the go.

- Here are some simple steps to help you get started, from figuring out how much money you could make to learning what day-to-day logistics are involved.

- Whether you work on Upwork or have a successful solo consulting practice, you’ll want to make sure you’re doing the right things for your taxes, credit, and well being.

- First, vacation rental owners must open a bank account that is specifically for their vacation rental business.

- You need to categorize each entry in your record, ensure the accounts balance, and turn all this information into financial statements for tax authorities.

Ever felt like you’re in a labyrinth when dealing with taxes as an Airbnb host? The world of Airbnb hosting comes with its own unique set of challenges, especially when tax season rolls around. In this in-depth exploration, we’ll uncover why having a specialized tax accountant is not just a luxury, but a necessity for Airbnb hosts. As a QuickBooks ProAdvisor, Mark has extensive knowledge of QuickBooks products, allowing him to create valuable content that educates businesses on maximizing the benefits of the software. If you have listings scattered across multiple hosting platforms, you may need something that can integrate with all of them (or that can get the job done regardless of integrations).

Want to receive more TechRepublic news?

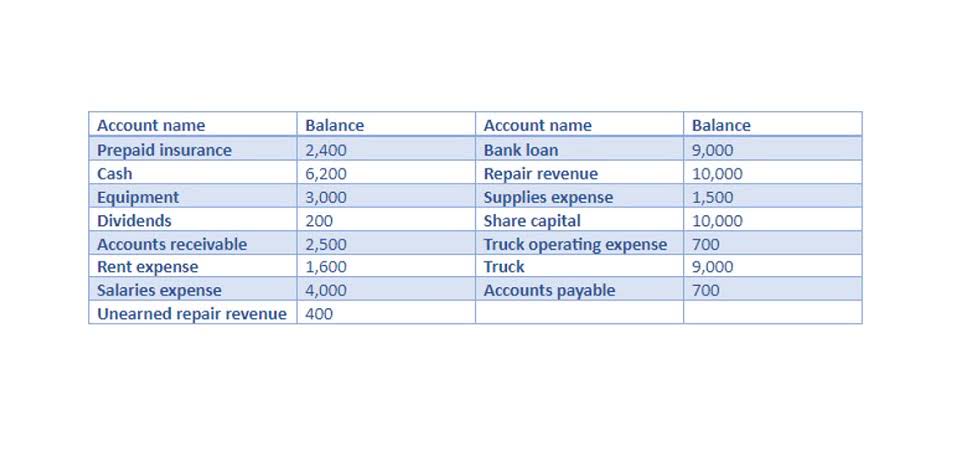

This table provides a quick summary of the different tax documents issued by Airbnb. For additional information, please check the relevant sections on this page. A specialised tax accountant helps in maintaining accurate and compliant records, significantly reducing the likelihood of an audit. In case of an audit, they can represent you, providing expert https://www.bookstime.com/ support and guidance through the process.